Businesses previously registered for GST will automatically be transferred to SST registrations. Your business name and address.

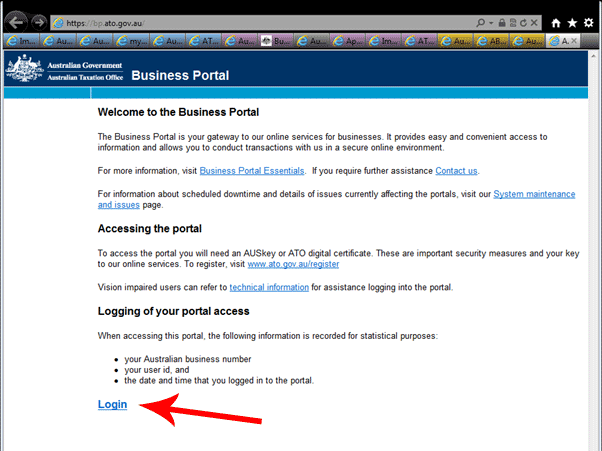

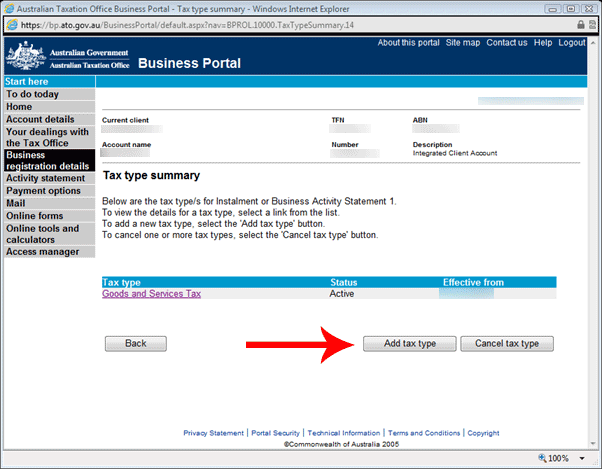

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

To continue to the next step.

. Select services from the GST Dashboard then registration from the services menu and then application for revocation of cancelled. Collecting GST in Malaysia. Your identification number whether in the form of.

Goods Services Tax GST Under Goods Services Tax GST system in Malaysia businesses with annual sales of RM500000 or more oblige to be registered under the GST. GST invoices in Malaysia. You can register for GST by clicking the Register for GST hyperlink on the GST TAP website.

Get approval confirmation in the system. How to Register for GST. This is currently set at RM 500000.

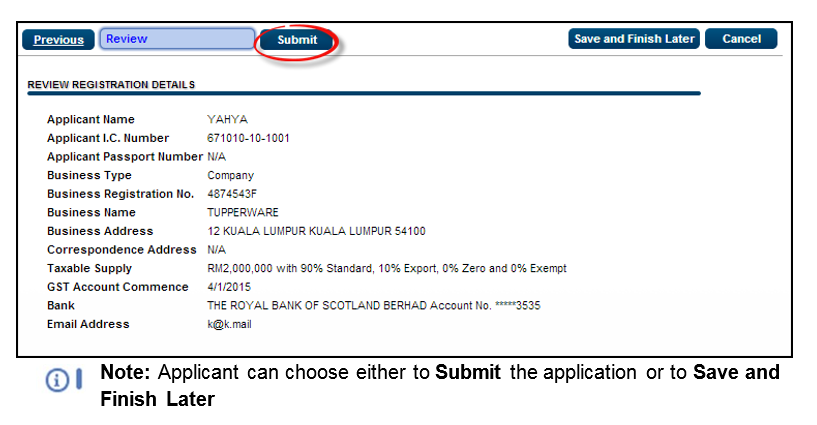

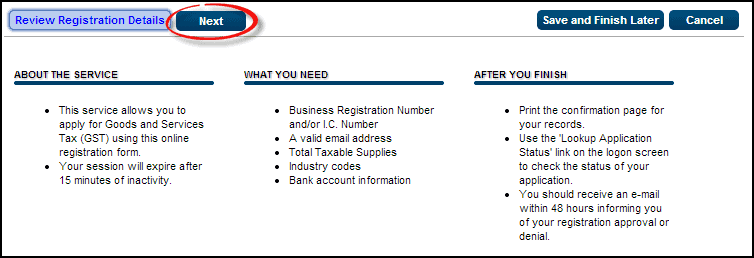

If your business annual sales do not exceed this amount you are not required to register for GST. You need to check whether you are required to register or whether you want to register voluntarily. The Review Registration Details is the instructions on TAP services to guide the taxpayer using TAP to register the.

How Can I Get GST Number In Malaysia. Once youre registered for taxes youre expected to charge 6 GST on every sale to a Malaysian resident. Registering your Business.

You have to complete registration form GST-01. Visit government portal. The registration process is online and can be found at the RMCD My-SST portal.

42 Where can I get the GST form. 2 Quickly register GST here httpsgstcustomsgovmyTAP_3 3 claim 1000 evoucher here httpgst-evouchersmecorpgovmygst from SMECorp government. The first step to being GST-ready is to register for a GST identification number.

3 The business conducted must operate in Peninsular Malaysia and the Federal Territory of Labuan. GST registration can be done manually or electronically via GST website. Under Goods Services Tax GST system in Malaysia businesses with annual sales of RM500 000 or more are required to be registered under the GST.

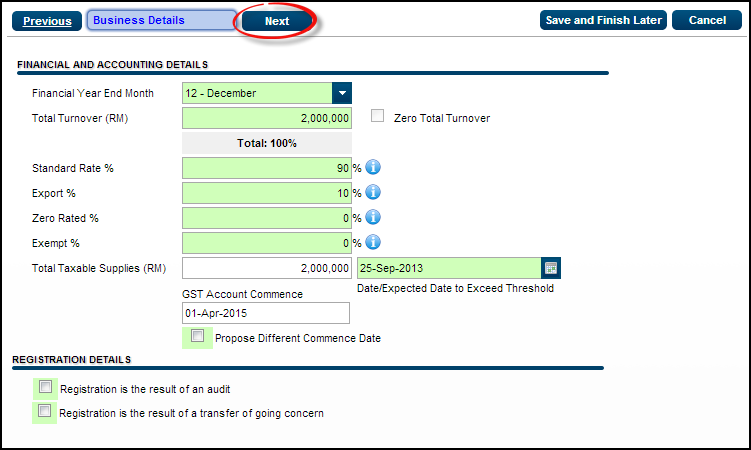

If your business annual sales do not exceed this amount you are not obliged to register for GST. You must apply for GST registration within 28 days from the date the annual taxable turnover exceed RM500000 determined based on either the historical or the future method. GST registered person who fulfilled the required criteria to be registered but were not registered by 1 September 2018 need to apply for registration through the MySST system within 30 days from the commencement date.

Such businesses can apply for voluntary registration. A taxable person who is mandatory to be registered under GST Act can complete the application by submitting the prescribed form GST-01. Once registration has been approved an approval letter will be generated by the system stating the sales tax registration number the effective date of registration Apply for registrationMonth liable to be registered not later than 30th.

Go to GST TAP website Click Register For GST hyperlink. Fill up the form with appropriate information. Registration is auto approve within 24 hour for a GST registrant.

You can register for GST by clicking Register For GST on the GST TAP website. Get sales tax registration number in the system. 1 A sole proprietor partnership shall register the business no later than 30 days from the date of commencement of the business.

In order to comply with tax laws you should include the following information on your invoices to customers in Malaysia. Enter the username and proper password to gain access to the account. How to Apply GST Number for Online Selling in 2022 Process for apply GST registrationHello Dosto mene is video mai bataya hai Gst Number ke liye kaise apply.

The registration forms can be obtained from the nearest Customs office or on-line from GST portal or website. Application can be made either on-line or manually by submitting to the nearest Customs office. A registered person who wants to apply for revocation online through the GST Portal should take the following steps.

Get recommended form for SST registration from the portal. Go to GST TAP website Click Register For GST hyperlink. Fill in all.

Resident businesses will be required to register for SST if they exceed the annual registration turnover threshold. Business registration number as provided by SSM. Generally the following important documents are required for GST registration purpose.

To continue to the next step. The Review Registration Details is the instructions on TAP services to guide the taxpayer using TAP to register the application. How can I get GST number in Malaysia.

Registering for GST could be a difficult task if you are not familiar with the process. Your business VAT number. Registration kiosks are provided at the SST Division in all RMCD offices throughout Malaysia.

GST-01 registration form is available at the nearest Customs office or you may download from the GST website ie. Go to the GST Portal. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustoms.

Business Registration Procedure. All the documents relating to the business or companies registration should be submitted upon request. 1 Getting Ready for GST - Registering for GST 2 Registration revised as at 23 April 2014 3 GST Electronic Services Taxpayer Access Point TAP Handbook 4 Click Multimedia Video for Registration.

Accounting for GST. You can start registering for GST either electronically via the GST portal or by filling up a manual form. Before submitting your application you should have the following information.

Persons having businesses with annual sales turnover exceeding RM500000 are liable to be registered under GST. Once filled submit the form online through the system itself. The effective date of registration is on the first day of the following month after the end of the twenty-eight days liability.

An application must be made in GST-01 form. Here is a step-by-step guideline that can help you to register GST and understand the tax system. The Review Registration Details section of TAP services contains instructions to assist taxpayers in.

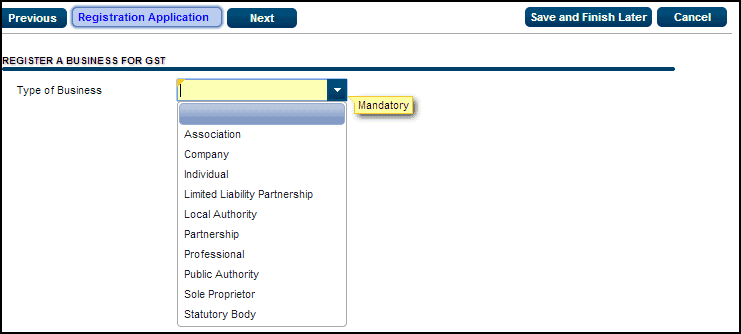

2 A business can be registered using personal name or trade name. When You Liable to Register For GST. Choose Type of Business.

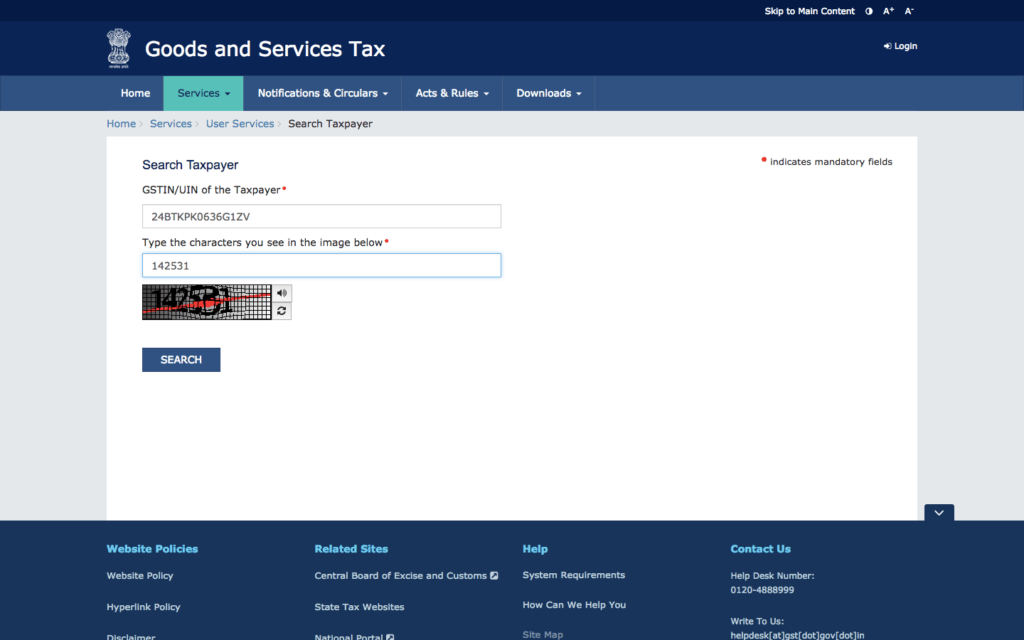

Gst Registration Check How To Check Gstin Validity Indiafilings

Functionality To Register Complaint Regarding Misuse Of Pan For Obtaining Gst Registration Introduced A2z Taxcorp Llp

Everything About Gst Registration Of An Llp Ebizfiling

Step By Step Guide To Apply For Gst Registration

Gst Registration Online Process Documents Fees Threshold

Step By Step Guide To Apply For Gst Registration

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

Gst Registration And Return Filing Service In Pan India Rs 1000 Id 21460365048

Everything About Gst Registration Of A Private Limited Company Ebizfiling

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Point Of Sales System Malaysia Online Pos System Pos Terminal Pos Cash Register Restaurant Cloud Simple Pos System Pos Office Phone

How To Apply For Gst And Pan For A Partnership Firm Ebizfiling

Step By Step Guide To Apply For Gst Registration

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Step By Step Guide To Apply For Gst Registration

What Is Gst Process To Download Gst Registration Certificate

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Registering For Gst Video Guide Youtube

Step By Step Guide To Apply For Gst Registration